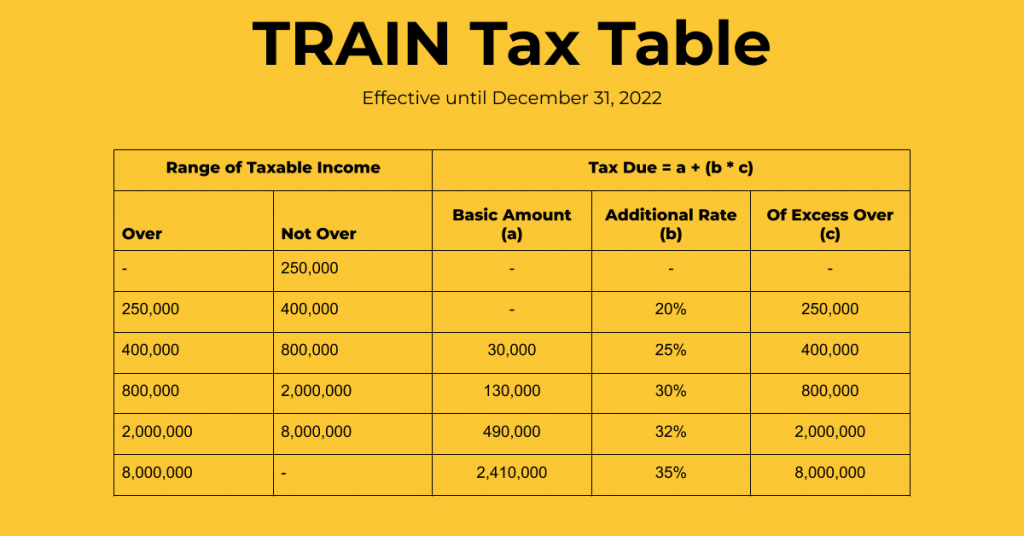

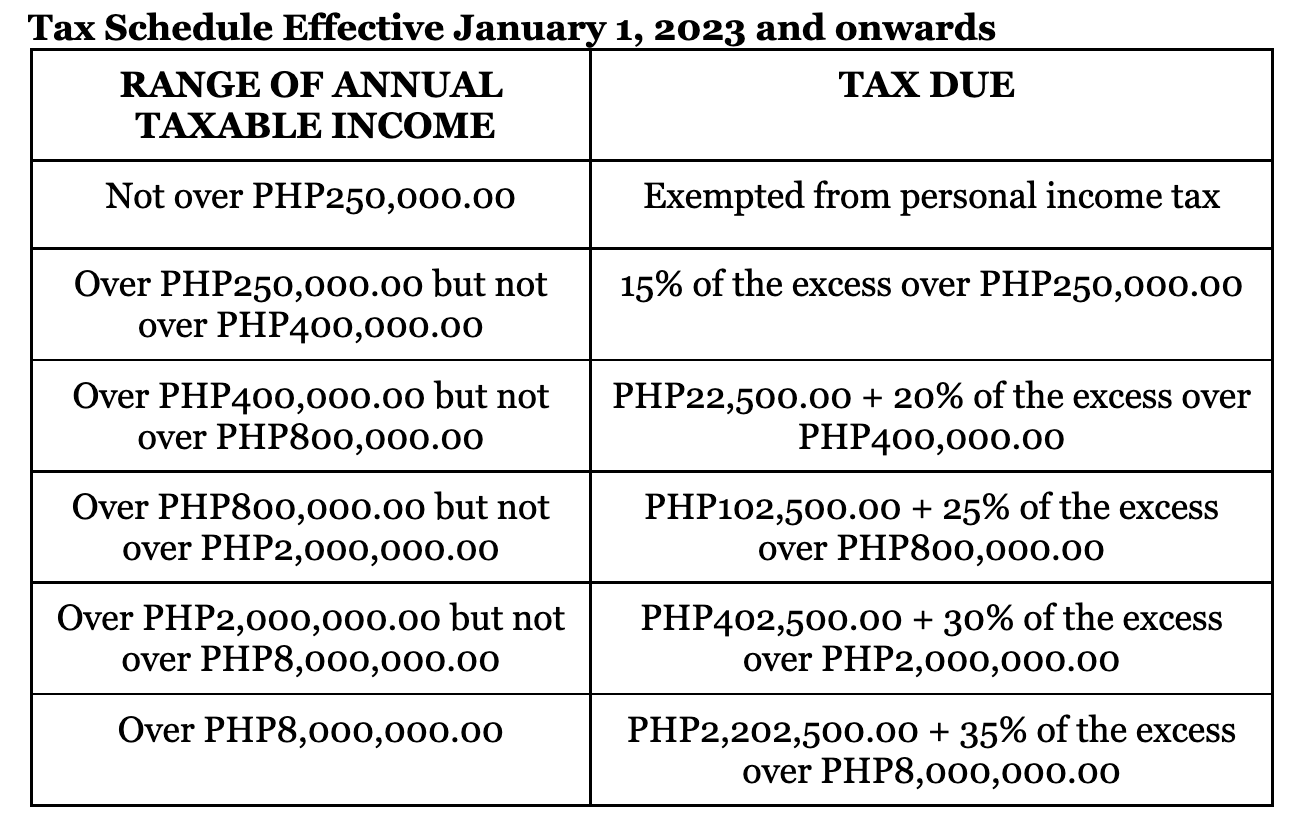

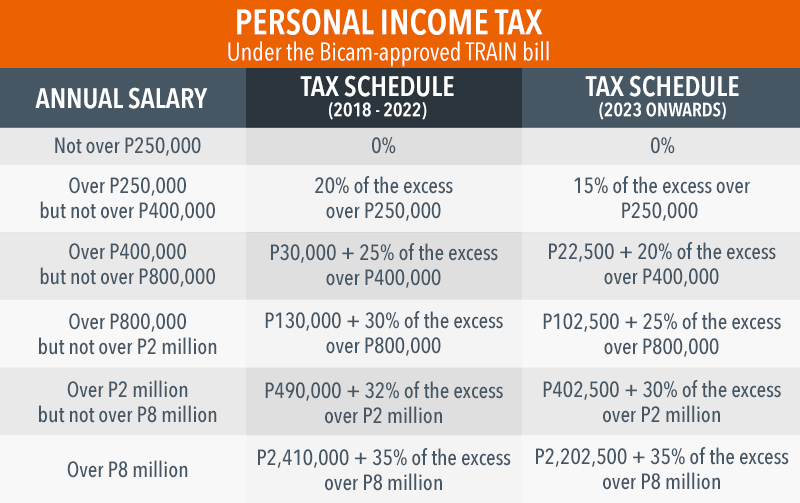

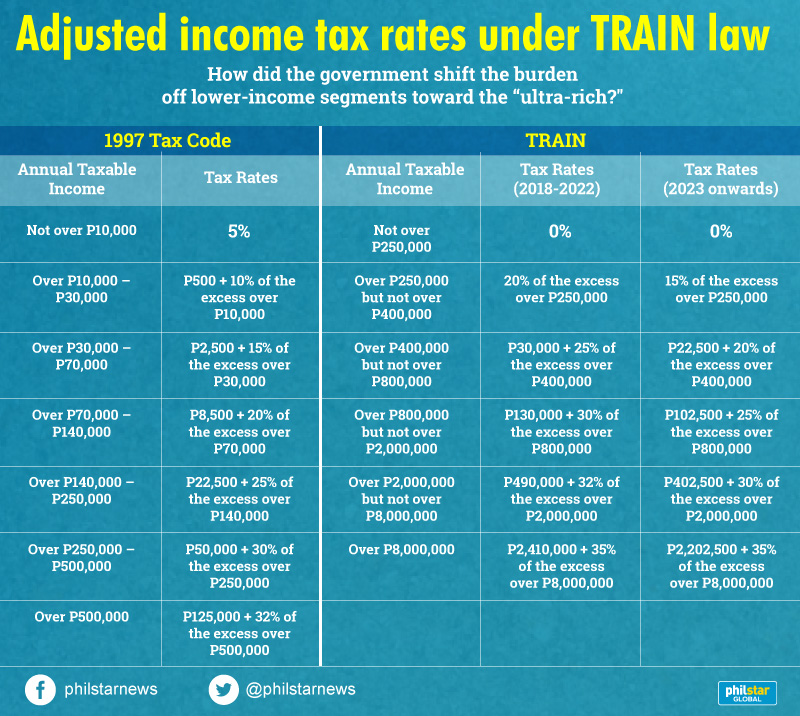

Train Law Tax Table 2024 Philippines. The content of this article may become outdated because of changes in the rules and regulations over time. Stay informed about tax regulations and calculations in philippines in 2024.

P3,000,000 to less than p20. The salary tax calculator for philippines income tax calculations.

Now, Based On The New Tax Table Under.

Under the train law, individuals and domestic corporations are subject to a flat tax rate of 15% already.

Advantages Of Bir Train Law On Income Tax;

To estimate the impact of the train law on your compensation income, click here.

Get Familiar With The Philippine Income Tax Table For 2024 And Know Your Tax Bracket, The Amount Owed, And How To Compute Your Tax Dues.

Images References :

Source: 2023vjk.blogspot.com

Source: 2023vjk.blogspot.com

10+ Calculate Tax Return 2023 For You 2023 VJK, The results will be displayed below it. So, the net pay after deductions is ₱30,452.45 on a monthly income of ₱35000 in the philippines.

Source: olinbarone.blogspot.com

Source: olinbarone.blogspot.com

tax rate philippines 2021 Olin Barone, An overview of the train law. Advantages of bir train law on income tax;

Source: www.pinterest.com

Source: www.pinterest.com

BIR withholding tax table 2018 Tax table, Withholding tax table, Tax, [5] the create act amendment rectifies what was. Under the train law, individuals and domestic corporations are subject to a flat tax rate of 15% already.

Source: www.spot.ph

Source: www.spot.ph

BIR Tax Schedule Effective January 1 2023, Identify all income sources, such as salary,. To access withholding tax calculator click here.

Source: www.philippinetaxationguro.com

Source: www.philippinetaxationguro.com

Effect of Train Law in the Philippine Tax TAXGURO, P3,000,000 to less than p20. New tax rates based on ra no.

Source: tax.modifiyegaraj.com

Source: tax.modifiyegaraj.com

Tax Refund 2022 23 Timeline TAX, There are several other features of a good tax system beyond revenue adequacy. Advantages of bir train law on income tax;

The Accountant's Journal 2018 Train Law The New Tax Table, The results will be displayed below it. To estimate the impact of the train law on your compensation income, click here.

How to Compute Withholding Tax Based on the Newly Enacted TRAIN Law, The content of this article may become outdated because of changes in the rules and regulations over time. Identify all income sources, such as salary,.

Source: aec.utcc.ac.th

Source: aec.utcc.ac.th

Winners and losers How the TRAIN law affects rich, poor Filipinos, Get an estimate of your tax due using the paypilipinas tax calculator. Train law tax table 2024 philippines.

Source: governmentph.com

Source: governmentph.com

Highlights of Tax Reform Law (TRAIN) See the Tax Rates for 2019, Check out the personal tax rates effective january 1, 2023. The content of this article may become outdated because of changes in the rules and regulations over time.

July 1, 2018 Until December 31, 2019:

[5] the create act amendment rectifies what was.

Determine If You’re Exempted From.

It does not substitute the need for inquiring professional.